Embark on a journey through chapter 3 journalizing transactions, where the intricacies of accounting unfold. This chapter 3 journalizing transactions answer key serves as an indispensable guide, providing a comprehensive understanding of the fundamental principles and techniques involved in journalizing transactions accurately and efficiently.

Delving into the intricacies of journalizing, we explore the process of recording financial transactions in a systematic manner, ensuring the integrity of accounting records. With clarity and precision, this answer key elucidates common journal entries, emphasizing the significance of accuracy in capturing financial data.

Journalizing Transactions: Chapter 3 Journalizing Transactions Answer Key

Journalizing transactions is the process of recording financial transactions in a journal. This process involves identifying the accounts affected by the transaction, determining the amount of the transaction, and recording the transaction in the journal. Journalizing transactions is an important step in the accounting process, as it provides a record of all financial transactions that have occurred during a period of time.

There are two main types of journal entries: simple journal entries and compound journal entries. Simple journal entries involve only two accounts, while compound journal entries involve three or more accounts. The following are examples of common journal entries:

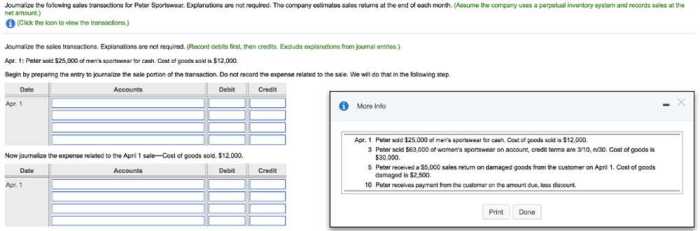

- To record the sale of inventory for cash:

- Debit: Cash

- Credit: Sales Revenue

- To record the purchase of equipment on account:

- Debit: Equipment

- Credit: Accounts Payable

- To record the payment of salaries:

- Debit: Salaries Expense

- Credit: Cash

It is important to be accurate when journalizing transactions. Errors in journalizing can lead to incorrect financial statements, which can have a negative impact on the business. Some common errors that students make when journalizing transactions include:

- Recording the wrong amount of the transaction

- Recording the transaction in the wrong account

- Omitting a transaction from the journal

There are a number of ways to avoid errors when journalizing transactions. These include:

- Using a journal template

- Reviewing journal entries for accuracy

- Using accounting software

Chapter 3 Journalizing Transactions Answer Key

The following is a detailed answer key for Chapter 3 journalizing transactions exercises:

- Exercise 3-1

- a. Debit: Cash $1,000; Credit: Sales Revenue $1,000

- b. Debit: Accounts Receivable $500; Credit: Sales Revenue $500

- c. Debit: Supplies Expense $200; Credit: Cash $200

- d. Debit: Prepaid Insurance $600; Credit: Cash $600

- e. Debit: Equipment $1,200; Credit: Accounts Payable $1,200

- Exercise 3-2

- a. Debit: Salaries Expense $1,000; Credit: Cash $1,000

- b. Debit: Rent Expense $500; Credit: Cash $500

- c. Debit: Utilities Expense $200; Credit: Accounts Payable $200

- d. Debit: Depreciation Expense $100; Credit: Accumulated Depreciation $100

- e. Debit: Cash $500; Credit: Accounts Receivable $500

Common Errors in Journalizing Transactions

Some common errors that students make when journalizing transactions include:

- Recording the wrong amount of the transaction

- Recording the transaction in the wrong account

- Omitting a transaction from the journal

These errors can be caused by a number of factors, including:

- Lack of understanding of accounting principles

- Carelessness

- Rushing

There are a number of ways to avoid these errors, including:

- Using a journal template

- Reviewing journal entries for accuracy

- Using accounting software

Advanced Journalizing Techniques

In addition to simple and compound journal entries, there are a number of advanced journalizing techniques that can be used to record complex transactions. These techniques include:

- Compound entries

- Reversing entries

- Memorandum entries

Compound entriesare used to record transactions that affect more than two accounts. For example, a compound entry could be used to record the sale of inventory on account. The following is an example of a compound entry:

- Debit: Accounts Receivable $1,000

- Debit: Sales Revenue $1,000

- Credit: Inventory $1,000

Reversing entriesare used to reverse the effects of a previous journal entry. For example, a reversing entry could be used to reverse the accrual of interest expense at the end of the accounting period. The following is an example of a reversing entry:

- Debit: Interest Expense $100

- Credit: Interest Payable $100

Memorandum entriesare used to record non-financial transactions. For example, a memorandum entry could be used to record the declaration of a dividend. The following is an example of a memorandum entry:

- Memorandum: Declared a dividend of $1 per share

Using Technology to Journalize Transactions

Technology can be used to streamline the process of journalizing transactions. There are a number of different accounting software programs that can be used to journalize transactions, including QuickBooks, Peachtree, and Sage 50. These programs can help to improve the accuracy and efficiency of the journalizing process.

When choosing an accounting software program, it is important to consider the following factors:

- The size of your business

- The complexity of your transactions

- Your budget

Once you have selected an accounting software program, you will need to set up the program and enter your company’s financial data. The program will then generate journal entries for you based on the data that you have entered.

Essential FAQs

What is the significance of accuracy in journalizing transactions?

Accuracy in journalizing transactions is paramount as it forms the foundation of financial records. Errors in journalizing can lead to incorrect financial statements, which can have severe consequences for decision-making and compliance.

What are some common errors in journalizing transactions?

Common errors include posting to incorrect accounts, omitting transactions, transposing numbers, and reversing debits and credits. These errors can arise due to carelessness, lack of understanding, or system issues.

How can technology assist in journalizing transactions?

Accounting software can automate journalizing tasks, reducing the risk of errors and saving time. These systems provide features such as pre-defined accounts, automatic posting, and error checking, enhancing the efficiency and accuracy of journalizing.