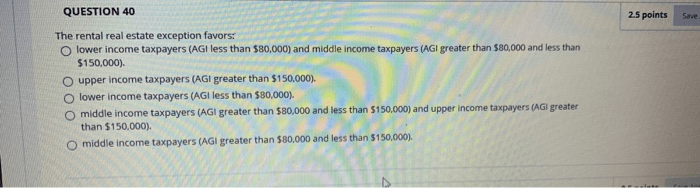

The rental real estate exception favors – The rental real estate exception, a tax provision designed to incentivize investment in rental properties, offers significant benefits to eligible taxpayers. By understanding the requirements and implications of this exception, investors can harness its potential to minimize their tax burden and maximize their returns.

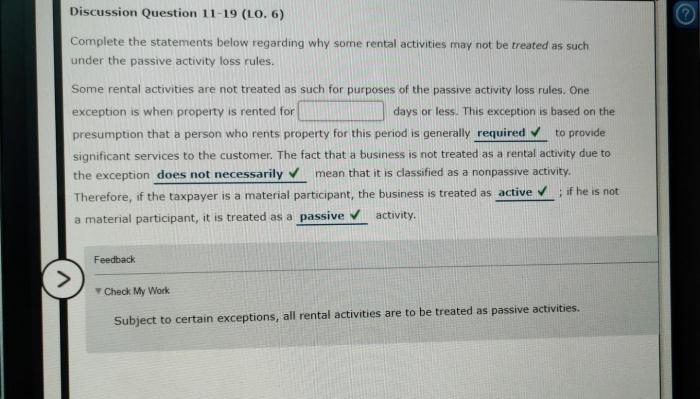

The rental real estate exception provides tax benefits to taxpayers who actively participate in the management of their rental properties and meet certain material participation requirements. This exception allows taxpayers to deduct losses from rental activities against their ordinary income, potentially reducing their overall tax liability.

1. Definition and Overview of the Rental Real Estate Exception: The Rental Real Estate Exception Favors

The rental real estate exception is a tax provision that allows certain taxpayers to exclude up to $25,000 of passive income from rental real estate from their taxable income. The purpose of the exception is to encourage investment in rental housing, which can provide affordable housing for low- and middle-income families.

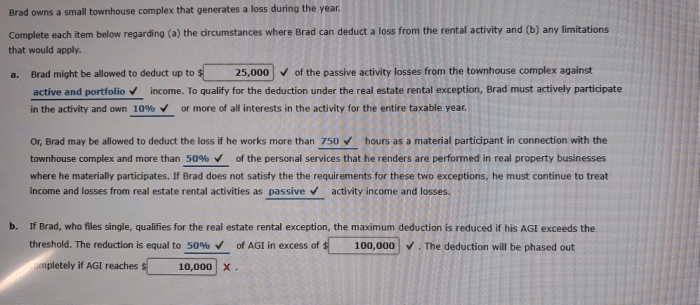

To qualify for the exception, taxpayers must meet the following requirements:

- Own at least 10% of the rental property.

- Actively participate in the management of the property.

- Materially participate in the property’s operations.

2. Eligibility Requirements

Ownership Requirements

To qualify for the rental real estate exception, taxpayers must own at least 10% of the rental property. This ownership interest can be held directly or indirectly through a pass-through entity, such as a partnership or S corporation.

Active Participation Requirements

Taxpayers must actively participate in the management of the rental property to qualify for the exception. This means that they must make significant and regular decisions about the property, such as setting rent, hiring and firing tenants, and maintaining the property.

Material Participation Requirements

Taxpayers must also materially participate in the property’s operations to qualify for the exception. This means that they must spend at least 750 hours per year working on the property or have significant involvement in the property’s management.

3. Tax Implications, The rental real estate exception favors

Tax Benefits of the Exception

The rental real estate exception can provide significant tax savings for taxpayers who qualify. The exception allows taxpayers to exclude up to $25,000 of passive income from rental real estate from their taxable income. This can result in a significant reduction in taxes owed.

Potential Tax Consequences of Not Meeting the Requirements

Taxpayers who do not meet the requirements for the rental real estate exception will be subject to ordinary income tax rates on their rental income. This can result in a significant increase in taxes owed.

Examples of How the Exception Can Save on Taxes

The following are examples of how the rental real estate exception can save on taxes:

- A taxpayer who owns a rental property that generates $30,000 of income per year can exclude $25,000 of that income from their taxable income under the exception, resulting in a tax savings of $5,000.

- A taxpayer who owns a rental property that generates $50,000 of income per year can exclude $25,000 of that income from their taxable income under the exception, resulting in a tax savings of $10,000.

4. Planning Considerations

Strategies for Maximizing the Benefits of the Exception

There are several strategies that taxpayers can use to maximize the benefits of the rental real estate exception. These strategies include:

- Owning multiple rental properties

- Actively participating in the management of the properties

- Materially participating in the properties’ operations

- Claiming the exception on a timely basis

Potential Pitfalls to Avoid When Using the Exception

There are also several pitfalls that taxpayers should avoid when using the rental real estate exception. These pitfalls include:

- Not meeting the ownership requirements

- Not actively participating in the management of the properties

- Not materially participating in the properties’ operations

- Claiming the exception on an incorrect tax return

Best Practices for Implementing the Exception

Taxpayers who are considering using the rental real estate exception should follow these best practices:

- Consult with a tax professional to ensure that they qualify for the exception.

- Keep accurate records of their ownership interest, participation in the management of the properties, and material participation in the properties’ operations.

- Claim the exception on their tax return in a timely manner.

5. Case Studies and Examples

Example 1

A taxpayer owns a rental property that generates $30,000 of income per year. The taxpayer actively participates in the management of the property and materially participates in the property’s operations. The taxpayer can exclude $25,000 of the income from the property from their taxable income under the rental real estate exception.

Example 2

A taxpayer owns a rental property that generates $50,000 of income per year. The taxpayer does not actively participate in the management of the property or materially participate in the property’s operations. The taxpayer cannot exclude any of the income from the property from their taxable income under the rental real estate exception.

Essential Questionnaire

What are the ownership requirements for the rental real estate exception?

To qualify for the exception, the taxpayer must have a direct or indirect ownership interest in the rental property.

How is active participation defined under the rental real estate exception?

Active participation involves making significant and bona fide decisions related to the management and operation of the rental property.

What are the material participation requirements for the rental real estate exception?

Material participation requires the taxpayer to spend a substantial amount of time performing services related to the rental property, such as repairs, maintenance, and tenant management.